EDPR's shareholder structure

EDPR shareholders are spread across more than 30 countries, being EDP the main shareholder. Since the successful Share capital increase in April 2021, where 88,250,000 new shares were issued at a subscription price of seventeen euros per share for a share premium of twelve euros, EDPR total share capital is composed of 960,558,162 shares with a nominal value of five euros each, fully paid. All these shares are part of a single class and series and are admitted to trading on the Euronext Lisbon regulated market.

Get to know the shareholder structure.

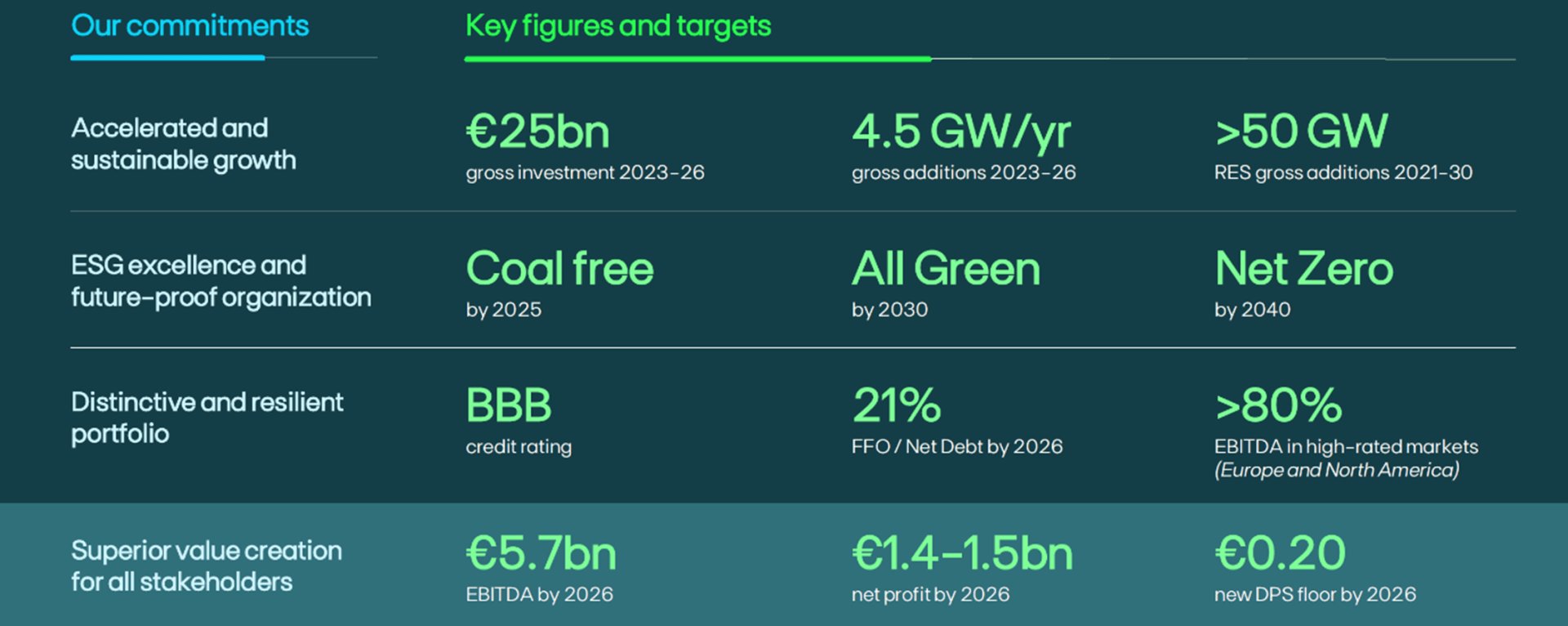

There is an undeniable new private and social commitment demanding and supporting an unparallel renewables growth to meet the requirements for a decarbonised and electrified world in which a clean, affordable, and reliable energy sector is at the centre of the economy. This will inevitably lead to an unparalleled growth of renewable energy that is expected to be supported by a continued decrease in renewables’ costs. EDPR has extensive experience in the sector and a track-record in delivering its targets, often ahead of schedule, and is prepared to deliver on a new and even more ambitious plan.

EDP Renewables reached an agreement in 2022 to acquire a 70% stake in Kronos Solar Projects GmbH Kronos Founders will retain a 30% stake in the company and continue involved in the daily management of the business.

Kronos has a lean development team with a long-term expertise based on a track record of more than 1.4 GW through 80 successfully commissioned projects and a portfolio of 9.4 GW (7.5 GWac) of solar projects in different stages of development in Germany (4.5 GW), France (2.7 GW), the Netherlands (1.2 GW) and the UK (0.9 GW). Out of the total 9.4 GW of pipeline of projects under development, 0.2 GW are Ready to Build.